Perks of Working With Our Financial Partners

Worried about financing your next home improvement? Oaks Roofing & Siding works with financial providers who offer flexible options to ensure you’re able to secure the funds you need for your home.

Our team will work with you to get the best rate for your home improvement project. Contact us to speak with one of our sales representative or more details.

Simple Application Process

Applying for financing is quick and easy. Connect with one of our team members who will assist you in filling out an online application form.

Flexible Loan Terms Up to 18 Months

With our finance offerings you have the flexibility of loan terms that work with your budget.

Finalize Your Loan With No Down Payment

When you qualify for a loan, there’s no down payment necessary. We offer soft inquiry pre-approvals, so you can explore options without affecting your credit score.

Oaks Roofing & Siding Financing Options

We offer a variety of financing options for homeowners. Call us today to discuss more details.

Competitive Interest Rates

With our low-interest loan options, you can finance your project at a competitive interest rate. Our team will work with you to find the best loan terms that suit your needs and budget – with no impact on your credit.

Monthly Payment Plan

We provide several fixed monthly payment options suited to your budget.

Current Financing Specials

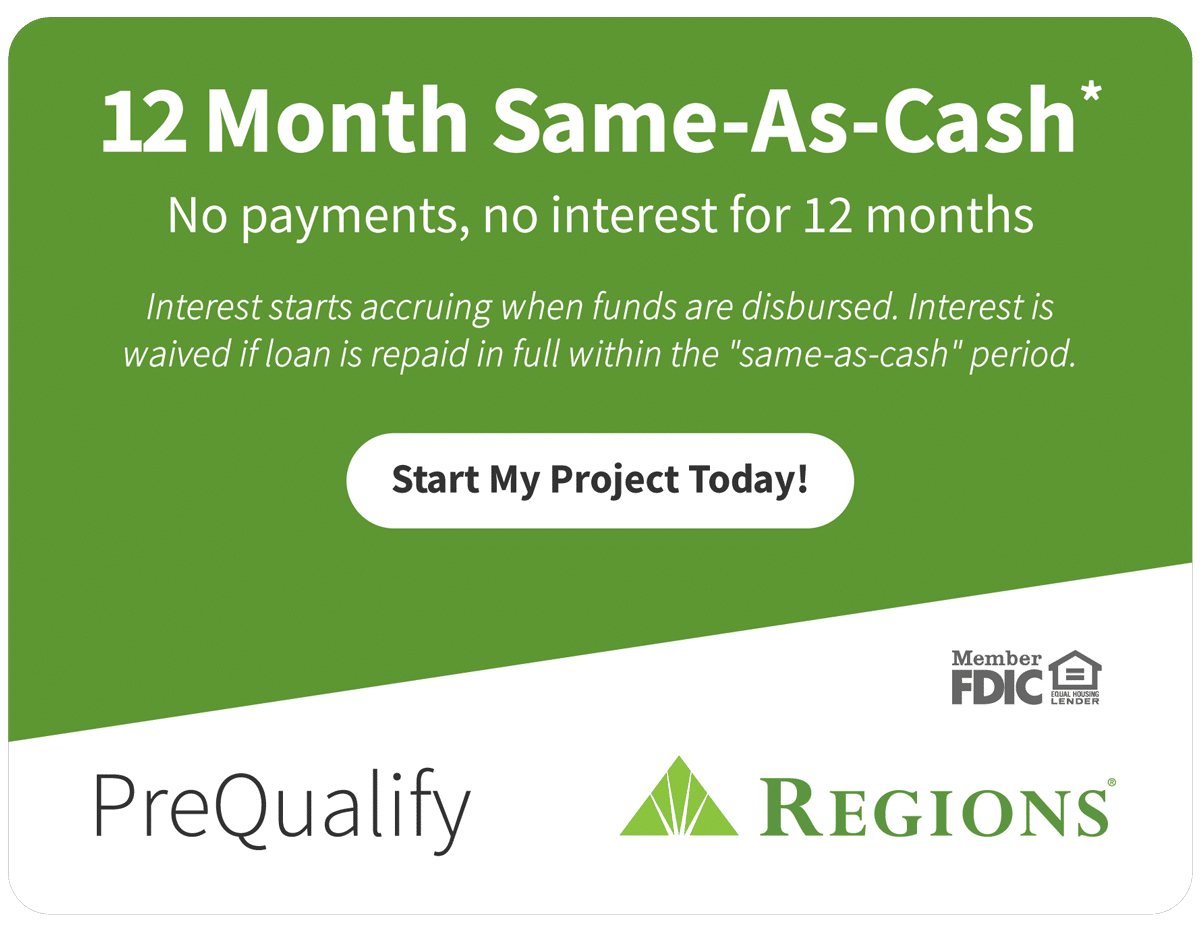

12-Month, Same-As-Cash Loan

*Credit and loans provided by Regions Bank, Member FDIC, (650 S. Main St., Suite 1000, Salt Lake City, UT 84101) on approved credit, for a limited time. 19.99% fixed APR (provided however, APR will not exceed 15.99% for residents of New Jersey and 17.99% for residents of Florida and Wisconsin), effective as of September 2025, subject to change. Minimum loan amounts apply. Interest starts accruing when funds are disbursed. Interest waived if repaid in 365 days from first disbursement. When open line period ends, the balance becomes a fixed rate installment loan; repayment terms vary from 24 to 132 months. Actual loan term may be shorter if less than the full approved amount of credit is used. First monthly loan payment due 365 days after first disbursement. If no payments made during same-as-cash period and APR of 19.99%, monthly payments vary from $21.99 to $30.82 per $1,000 borrowed depending on term. The minimum monthly payment will be no less than $50.00.

Competitive, Low Rates

*Credit and loans provided by Regions Bank, Member FDIC, (650 S. Main St., Suite 1000, Salt Lake City, UT 84101) on approved credit, for a limited time. 7.99% fixed APR, subject to change. Minimum loan amounts apply. Interest starts accruing when funds are disbursed. Open line period payments due 90 days after origination and monthly thereafter during open line period. When open line period ends, the balance becomes a fixed rate installment loan; repayment term is 84 months. Actual loan term may be shorter if less than the full approved amount of credit is used. First monthly loan payment due 30 days from the end of the open line period. 84 monthly payments of $15.79 per $1,000 borrowed. The minimum monthly payment will be no less than $50.00.

Lower Monthly Payments

*Credit and loans provided by Regions Bank, Member FDIC, (650 S. Main St., Suite 1000, Salt Lake City, UT 84101) on approved credit, for a limited time. 10.99% fixed APR, subject to change. Minimum loan amounts apply. Interest starts accruing when funds are disbursed. Open line period payments due 90 days after origination and monthly thereafter during open line period. When open line period ends, the balance becomes a fixed rate installment loan; repayment terms vary from 12 to 144 months. Actual loan term may be shorter if less than the full approved amount of credit is used. First monthly loan payment due 30 days from the end of the open line period. Monthly payments vary from $12.76 to $21.49 per $1,000 borrowed depending on term. The minimum monthly payment will be no less than $50.00.

Our Financing Process

Flexible Financing Guided by Experts

At Oaks, we believe financing your home improvement project should be simple, transparent, and stress-free. That’s why we have a dedicated financial advisor on staff—a real person you can speak with one-on-one—who will use our network of trusted lenders and resources to help you secure the lowest interest rate possible for your unique situation.

Explore you Options

Contact Oaks Roofing & Siding to discuss financing options or start your application today.

Our Financing Team

Our financing team takes the time to get to know you and your project. They’ll review your situation, walk you through all available loan and payment options, and answer every question — no pressure, no guesswork. Their mission is simple: to help you secure the lowest interest rate possible using Oaks’ trusted network of lenders and financial partners.

Our in-house financial advisors bring years of experience helping homeowners find the right financial path for their projects. They understand that no two homeowners are alike — and that’s why every recommendation is tailored, not templated.

- Personal guidance: You’ll have access to an experienced financial advisor who understands home improvement financing and can explain your options in plain language.

- Transparent process: From soft inquiry pre-approvals to same-day approvals, we’ll outline exactly what to expect and what works best for your goals.

- No hidden motives: Our team isn’t motivated by dealer fees or bonuses — we do this to make your project more affordable, not to profit from your financing.

- All-in-one support: Whether you prefer a no-interest option, a flexible monthly payment plan, or a cash/check job, our financing experts will help you compare and choose what’s best for your home and budget.

Want to know what options will be best for you? Contact our Finance Manager, Kevin Lofthouse, by emailing [email protected] or calling 585-734-0163.